The agricultural global value chain involves transforming raw agricultural commodities into edible goods and encompasses a wide array of activities and participants. This consolidated network is vital for economic resilience, particularly in regions such as North Africa and the Middle East, where agriculture accounts for a significant portion of GDP. Cereals, as a key component of the value chain, highlight the importance of this sector in maintaining global food security. Cereal production and maintenance are multi-process endeavours, from production to processing, each with its own set of challenges and opportunities for innovation. The dynamics of this chain underline the need for effective mechanisms to mitigate external shocks, such as climate change and geopolitical conflicts, which have a significant impact on cereal production.

Countries in the MENA region are particularly vulnerable to international shocks in cereal markets due to their heavy reliance on imports to meet domestic food demand. A comprehensive understanding of these external shocks, underlying stressors and appropriate coping strategies is crucial — especially for public authorities, who play a central role in designing effective policy responses.

Climate change has made food production more difficult.

Soil degradation, caused by urbanization, population

growth and unsustainable practices, adds further strain

to MENA countries’ agricultural potential

This article contributes to that understanding by aligning with the objectives of the STAPLES Project (STable food Access and Prices and Lower Exposure to Shocks), which aims to support the development of resilience strategies in the MENA region. The STAPLES project is part of the PRIMA programme, supported by the European Union under Grant Agreement No. 2333. The project focuses on generating, organizing and sharing evidence-based insights on external stressors and shocks originating from global cereal value chains, with particular attention to Morocco and Egypt — two of the region’s largest cereal importers and most exposed food systems (additional information can be found at this link: https://www.staples-project.eu/).

Egypt and Morocco, like most MENA countries, are plagued by severe agricultural development issues compounded by climate change, water scarcity and high population growth. Such exposure increases susceptibility to external shocks and strains the development of adaptation measures to preserve food security. Government policies play a crucial role in mitigating these effects through subsidies, strategic inventories and trade diversification. A review of recent shocks, such as the Covid-19 pandemic and the Russia-Ukraine conflict, reveals the challenges that must be navigated to maintain stable food availability and market conditions. Egypt and Morocco have managed to avoid these challenges, highlighting the importance of maintaining stable prices for basic cereals and ensuring a steady supply of essential commodities through forward stockpiling and strategic reserves. Understanding the dynamics of the agricultural value chain, and more specifically, the cereals value chain, is necessary to address the food security predicaments of Egypt and Morocco. By recognizing these dynamics, public authorities can develop more robust food systems that are resilient to external forces and support the well-being of their populations.

Overview of the Agricultural Value Chain

The agricultural value chain represents a holistic system encompassing all activities and participants involved in bringing an agricultural product from its initial production in the field to its final consumption by the end user. Rather than a linear sequence, it forms a complex network where each stage adds value, in a sector that still contributes over 11% to GDP in Egypt and Morocco, and similarly in Algeria (13.1%) and Tunisia (9.5%). On the other hand, the impact of this industry in Middle Eastern countries like Jordan and Lebanon is lower, amounting to 4.8% and 1.2%.

This chain can be broadly divided into two segments: upstream agriculture and the downstream food and beverages (F&B) industry. For both sectors, we computed global value chain (GVC) participation indicators using OECD Trade in Value Added (TiVA) data, following Borin & Mancini (2023). Our analysis focuses on Morocco and Egypt, with additional consideration for Algeria, Jordan, Lebanon and Tunisia — countries at the core of the STAPLES Project.

GVC participation is measured as the sum of backward (foreign inputs in exports) and forward (domestic inputs embedded in third-country exports) linkages, reflecting potential exposure to global shocks in these two sectors. As of 2020, both Egypt and Morocco show strong forward participation in agriculture and backward participation in the F&B industry. Morocco is highly engaged in GVCs, with participation rates of 22.2% in agriculture and 24.4% in F&B, compared to Egypt’s 15% and 16.1%. Tunisia shows a similar forward-backward pattern and levels of integration as Morocco (22.4% and 33.6%). Jordan is the most integrated with 26.9% participation in agriculture and 35% in F&B, although it is mainly backward oriented (22.9% and 32.4%), highlighting a high dependency on foreign inputs for agri-food production.

Much of Morocco’s foreign value-added comes from the US, Russia and China, suggesting vulnerability to shocks in these economies. However, when focusing on cereals, Egypt appears more vulnerable to external factors — particularly to disruptions in major hubs like Russia and Ukraine — than Morocco.

In 2022, cereals represented the largest share of global primary crop production and remained the most traded agricultural commodities. These crops provide a substantial share of the world’s caloric intake and are essential to food systems. With the global population projected to approach 10 billion by 2050, ensuring a stable and reliable supply of cereals is critical. Any major disruption would seriously undermine global food security, increasing the risk of widespread hunger and malnutrition.

The Cereals Value Chain (CVC) spans input supply, production, post-harvest handling, processing, packaging, distribution, marketing and final consumption — each stage presenting challenges but also opportunities for improvement. Given the central role of cereals in the diets of populations in Egypt and Morocco, ensuring the resilience of this value chain is essential for maintaining nutritional security and mitigating the impact of external shocks on food systems.

Domestic Challenges Facing the CVC

These two North African countries face persistent agricultural development challenges and remain highly vulnerable to external shocks. These challenges are driven by a mix of supply- and demand-side pressures, which threaten progress toward poverty reduction and food security.

On the supply side, climate change — manifested in rising temperatures, lower rainfall and increased water demand — has made food production more difficult. In Morocco, cereal output dropped sharply in 2016 and 2022 due to drought, although overall agricultural production rebounded in 2023, contributing 0.7 percentage points to GDP growth. Soil degradation, caused by urbanization, population growth and unsustainable practices, adds further strain to MENA countries’ agricultural potential.

Water scarcity is another critical constraint, in a region where this poses a bigger problem than anywhere else in the world. By 2030, per capita water availability is expected to drop below the absolute scarcity threshold of 500 cubic metres per year, further strained by ongoing population growth. Egypt has already passed the water poverty threshold and faces an annual water deficit of approximately 54 billion cubic metres. Nearly 60% of the country’s food production takes place in the Nile Delta, making it particularly vulnerable to fluctuations in water availability. In this regard, the combined effects of water scarcity and the increasing frequency of extreme weather events — such as the severe drought that struck Morocco between February and March 2024 — are at the heart of the country’s historically low wheat production, estimated at just 2.5 million tonnes, the lowest level in more than 15 years. In this context, virtual water trade can offer a short-term solution by alleviating local water stress and reducing the risk of acute shortages.

According to FAOSTAT, agricultural land in Egypt made up only 3.9% of the total area in 2019, rising slightly to 4.08% by 2022 — all of it irrigated (Map 1). However, the share of arable land within this total declined from 83% (3,219 thousand hectares) to 76.5% (3,103 thousand hectares). In contrast, Morocco allocated 66.6% of its land to agriculture in 2019, increasing this figure to 68.1% by 2022. The share of arable land rose from 23.3% (6,899 thousand hectares) to 25% (7,512 thousand hectares). However, only about 20% of this land is equipped for irrigation, indicating a strong dependence on rainfall. This reliance is even greater in Tunisia and Algeria, where irrigated land represents an even smaller share. Conversely, irrigation plays a more significant role in Lebanon and Jordan, where nearly 40% of croplands are irrigated, as shown in Chart 1.

MAP 1 Agro-Ecological Zones for Egypt

Source: Graphical representation taken from the Climate Adaptation in Rural Development – Assessment Toolplatform for Northern Africa, Climate Adaptation in Rural Development (CARD) Assessment Tool, www.ifad.org/en/w/publications/climate-adaptation-in-rural-development-card-assessment-tool.

CHART 1 Land Area Equipped for Irrigation (% Cropland)

Source: Compiled by the authors using FAOSTAT.

On the demand side, rapid population growth and urban expansion have placed increasing pressure on agricultural systems. Egypt, the most populous country in the region, reached 100 million inhabitants in 2020, after decades of an average 2.1% annual population growth; a rate that declined slightly to 1.7% by 2023. Morocco, with a population of 36.6 million in 2020, continues to grow steadily at around 1% per year. This growth persists despite a significant drop in fertility rates — from 5.5 to 2.3 children per woman over the past fifty years.

Unplanned urban sprawl has led to the loss of vast areas of fertile land — an estimated 30,000 hectares annually in Egypt. This compounds agricultural stress, particularly in poorer regions.

Poverty significantly affects agricultural vulnerability. In 2015, 27.8% of the Egyptian population lived in poverty, and an additional 28.7% were at risk of falling into poverty — mostly in Upper Egypt (World Bank, 2019). These households are disproportionately exposed to climate risks such as droughts and heatwaves, and they often depend directly on agriculture for their livelihoods.

In contrast, Morocco has experienced stronger economic growth since the early 2000s, maintaining macroeconomic stability and keeping inflation under control. Public investments in infrastructure, along with increased credit availability and higher remittance flows from Moroccan emigrants, have contributed to poverty reduction.

As a result of these measures, Morocco’s poverty rate declined to below 9% on the eve of the Global Financial Crisis (GFC), down from over 13% in 1990. This declining trend continued in 2019, with poverty affecting just 4% of rural households and 0.5% of urban households.

Although the two countries have shown different levels of success in tackling poverty, household income in both remains heavily devoted to food consumption. According to the USDA Economic Research Service (ERS), in 2023 food accounted for the largest share of total consumer expenditure — 36.9% in Morocco and 34.5% in Egypt. This high reliance on food spending amplifies the effects of price shocks, worsening food insecurity among vulnerable groups.

Trade Challenges Facing the CVC

Most of this expenditure is directed to the purchase of cereals that not only constitute the primary source of dietary energy worldwide, but are even more critical in the African region, where Egypt and Morocco rely heavily on imports to meet domestic consumption needs. Using BACI-CEPII data on bilateral trade in barley, maize, rice and wheat from 1995 to 2023, we compute network density — defined as the ratio of actual to potential trade connections — to track market integration and disruptions.

Trade connectivity rose from about 7% in 1995 to over 12% in 2023, but key global events moved against this trend. No decline occurred during the GFC, when density kept rising. In contrast, Covid-19 caused a temporary drop followed by a sharp V-shaped rebound in 2021. The war in Ukraine, however, triggered a more lasting decline, with density falling further in 2023.

CHART 2 Density Trend, 1995-2023

Source: Compiled by the authors using the BACI CEPII database.

As unprocessed cereals trade remained stable during the 2007–2008 crisis, the analysis is limited to the more recent shocks: Covid-19 and the Russia-Ukraine conflict.

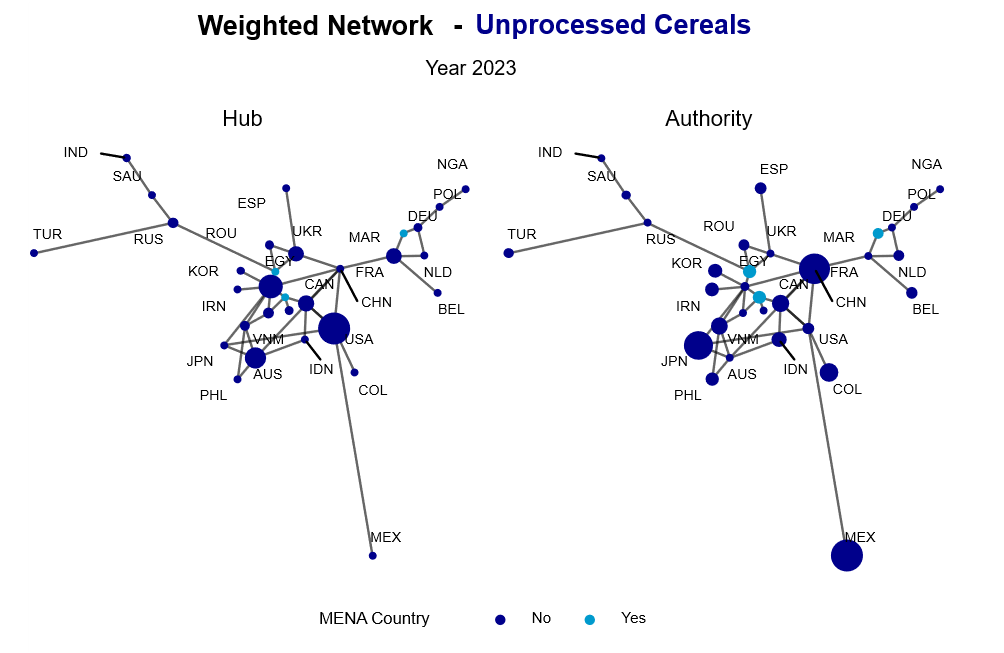

Between 2019 and 2023, Egypt’s imports of unprocessed cereals declined from $7.37 billion to $5.66 billion. Despite this drop, Egypt remains a major importer from key global suppliers such as Brazil, Ukraine and Russia, as shown in the 2023 network graph below. In contrast, among the other MENA countries — whose nodes are highlighted in light blue — only Algeria and Morocco appear as peripheral actors in the authority network, with no significant trade linkages observed for the others. This marginal position can again be seen in the wheat-specific network for the same year.

CHART 3 Hub and Authority Network for Unprocessed Cereals, 2023

Source: Compiled by the authors using the BACI CEPII database.

Indeed, Egypt’s central position as a buyer of unprocessed cereals in international markets is primarily driven by its exceptionally high demand for wheat, even before the two recent crises, as illustrated below. While a few other MENA countries appear in the authority network, they do not play a comparably significant role. Egypt’s growing centrality, however, has heightened its vulnerability to external shocks originating in key supplier countries — most notably, the ongoing Russian aggression against Ukraine, both of which were key hubs in 2019.

CHART 4 Hub and Authority Network for Wheat, 2019

Source: Compiled by the authors using the BACI CEPII database.

The decline in Ukraine’s role as a wheat exporter in 2023, compared to four years earlier, has undermined Egypt’s position as a key importer of unprocessed cereals, highlighting the urgent need for the country to diversify its sources of supply. In contrast, Russia has maintained its status as a major wheat exporter.

CHART 5 Hub and Authority Network for Wheat, 2023

Source: Compiled by the authors using the BACI CEPII database.

On the other hand, Morocco’s cereal imports more than doubled — from $1.46 to $2.81 billion — partly due to agricultural policies implemented under the Green Morocco Plan (2008–2020) and continued with Generation Green 2020–2030, which have boosted fruit and vegetable exports while simultaneously increasing reliance on grain imports.

Over the same period, we have analysed the top 10 exporters to both countries (by volume and value) to capture shifts in supplier composition and the impact of price fluctuations on trade patterns.

TABLE 1 Top 10 Unprocessed Cereal Exporters for Egypt, Value

| Egypt | |||||

| Imports of Unprocessed Cereals | 2019 | 2020 | 2021 | 2022 | 2023 |

| Tot. Value, thousands of USD | 7,374,742 | 7,182,481 | 6,868,714 | 7,221,432 | 5,674,107 |

| Annual Variation (%) | 16.26 | -2.61 | -4.39 | 5.14 | -21.43 |

| Share of Top 10 Exporting Countries (%) | |||||

| Russian Federation | 34.61 | 44.81 | 35.60 | 23.18 | 45.02 |

| Ukraine | 26.81 | 24.03 | 20.05 | 10.04 | 12.20 |

| Romania | 9.19 | 4.31 | 14.50 | 15.09 | 14.33 |

| Brazil | 7.49 | 7.68 | 9.71 | 15.27 | 7.60 |

| Argentina | 5.93 | 8.88 | 10.16 | 8.64 | 6.78 |

| USA | 5.55 | 0.84 | 2.70 | 2.34 | 1.53 |

| France | 4.67 | 4.92 | 2.00 | 14.17 | 3.92 |

| China | 1.82 | 0.99 | 1.18 | 2.10 | 1.45 |

| India | 1.18 | 0.39 | 0.71 | 1.61 | 1.81 |

| Poland | 0.87 | 0.00 | 0.01 | 0.00 | 0.00 |

Source: Compiled by the authors using the BACI CEPII database.

TABLE 2 Top 10 Unprocessed Cereal Exporters for Egypt, Quantity

| Egypt | |||||

| Imports of Unprocessed Cereals | 2019 | 2020 | 2021 | 2022 | 2023 |

| Tot. Quantity, in metric tons | 2.40e+07 | 3.39e+07 | 2.67e+07 | 1.33e+07 | 1.76e+07 |

| Annual Variation (%) | -23.81 | 41.25 | -21.24 | -50.19 | 32.33 |

| Share of Top 10 Exporting Countries (%) | |||||

| Ukraine | 31.74 | 24.97 | 21.05 | 16.03 | 22.89 |

| Russian Federation | 25.62 | 41.43 | 32.75 | 1.28 | 35.12 |

| Brazil | 13.62 | 9.36 | 12.36 | 30.08 | 9.26 |

| Argentina | 11.30 | 11.87 | 11.76 | 18.17 | 8.00 |

| Romania | 7.83 | 4.29 | 13.75 | 12.83 | 13.49 |

| USA | 3.48 | 0.56 | 2.31 | 2.15 | 1.05 |

| France | 3.14 | 4.06 | 1.68 | 9.52 | 3.67 |

| China | 0.67 | 0.77 | 0.94 | 3.60 | 0.67 |

| Poland | 0.67 | 0.00 | 0.01 | 0.00 | 0.00 |

| Bulgaria | 0.42 | 0.43 | 0.03 | 1.88 | 1.94 |

Source: Compiled by the authors using the BACI CEPII database.

Network representations confirm that in 2019, Russia and Ukraine were Egypt’s primary cereal suppliers, benefiting from competitive prices, lower transport costs and proximity. During the Covid-19 pandemic, Egypt’s cereal imports declined — first in 2020 due to falling prices, then again in 2021 due to weaker demand. While Russia’s share of Egyptian imports increased, Ukraine’s dropped sharply after the 2022 invasion, which disrupted MENA cereal supply chains. Russian wheat export prices surged to $410 per ton in March 2022 before stabilizing back to mid-2021 levels by March 2023 (FAOSTAT).

The surge in global wheat prices caused Egypt’s import bill to rise slightly — by just over 5% — despite a drop of more than 50% in import volumes. Amid inflationary pressures, the Egyptian government banned exports of staple foods — including wheat — from March to September 2022, in order to safeguard domestic reserves.

Similar dynamics occurred elsewhere in the region. In Tunisia, Russia overtook Ukraine as the top supplier in 2023 (20.4% vs 17.2%), while Lebanon still heavily depends on Ukraine (41%) and Russia, despite the latter’s declining share (from 33.5% in 2015 to 23.4% in 2023). Other exporters — Brazil, Argentina, China and Romania — partially filled the gap. Argentina became Algeria’s top supplier (19.5%), and Romania played a key role for Jordan (29.9%).

CHART 6 Wheat Price Trends for Russian and Ukrainian Exports, January 2019 – March 2025

Source: Compiled by the authors using FAOSTAT.

TABLE 3 Top 10 Unprocessed Cereal Exporters for Morocco, Value

| Morocco | |||||

| Imports of Unprocessed cereals | 2019 | 2020 | 2021 | 2022 | 2023 |

| Tot. Value, thousands of USD | 1468912 | 2026899 | 1985178 | 3194669 | 2814434 |

| Annual Variation (%) | 7.99 | 37.99 | -2.06 | 60.93 | -11.90 |

| Share of Top 10 Exporting Countries (%) | |||||

| France | 29.59 | 23.94 | 16.24 | 42.49 | 23.70 |

| Argentina | 18.32 | 12.73 | 20.38 | 15.46 | 7.45 |

| Canada | 13.55 | 15.40 | 14.69 | 11.79 | 14.17 |

| Ukraine | 13.19 | 12.59 | 15.48 | 0.90 | 0.83 |

| Brazil | 12.32 | 8.79 | 4.33 | 8.84 | 11.43 |

| Russian Federation | 6.97 | 4.68 | 1.57 | 0.44 | 3.57 |

| USA | 1.48 | 1.21 | 8.75 | 3.50 | 3.51 |

| Germany | 1.31 | 5.79 | 3.52 | 6.58 | 14.79 |

| Thailand | 0.56 | 0.61 | 0.16 | 0.32 | 0.16 |

| Lithuania | 0.45 | 0.35 | 0.88 | 1.70 | 2.88 |

Source: Compiled by the authors using the BACI CEPII database.

TABLE 4 Top 10 Unprocessed Cereal Exporters for Morocco, Quantity

| Morocco | |||||

| Imports of Unprocessed Cereals | 2019 | 2020 | 2021 | 2022 | 2023 |

| Tot. Quantity, in metric tons | 7,349,898 | 9,593,136 | 7,333,600 | 8,997,267 | 9,573,952 |

| Annual Variation (%) | 9.53 | 30.52 | -23.55 | 22.69 | 6.41 |

| Share of Top 10 Exporting Countries (%) | |||||

| France | 27.32 | 22.57 | 15.10 | 40.27 | 23.87 |

| Argentina | 22.25 | 16.48 | 23.51 | 19.40 | 7.79 |

| Brazil | 14.63 | 10.69 | 5.63 | 10.79 | 12.79 |

| Ukraine | 13.92 | 13.70 | 16.63 | 1.09 | 0.87 |

| Canada | 10.90 | 11.43 | 11.58 | 7.88 | 9.21 |

| Russian Federation | 6.31 | 4.71 | 1.59 | 0.55 | 3.98 |

| USA | 1.35 | 1.13 | 8.48 | 3.66 | 3.01 |

| Germany | 1.33 | 5.59 | 3.44 | 7.01 | 16.59 |

| Poland | 0.45 | 1.58 | 6.16 | 1.97 | 2.99 |

| Lithuania | 0.45 | 0.39 | 0.94 | 1.58 | 2.96 |

Source: Compiled by the authors using the BACI CEPII database.

On the other hand, Morocco was less directly affected by price fluctuations during the two crises. However, it bore a significant cost from increased import volumes in the aftermath of the war in Ukraine, with quantities rising by 22.7% and import values surging by 60.9%, despite Ukraine and Russia being only its fourth- and sixth-largest cereal suppliers, respectively. Throughout the period, Morocco maintained a strong reliance on imports from France, particularly in 2022. The following year, Argentina’s position declined, falling from second to fifth place, while Germany emerged as Morocco’s second-largest supplier. Nevertheless, in both Egypt and Morocco, cereal import values fell sharply following the steep decline in global cereal prices.

Government Policy Response to External Shocks

Government policies play a crucial role in shaping the economic viability of cereal production, influencing farmer incomes and market stability, while trade policies, such as tariff and non-tariff measures can impact cereal prices and market competitiveness. Therefore, government interventions are critical for creating a supportive environment for cereal production and ensuring the economic well-being of farmers. For instance, to tackle the recent drop in cereal production, particularly in wheat, the Moroccan government increased subsidies on wheat and barley seeds, causing prices to drop by five and three percent, respectively, compared to 2024, with the aim of encouraging domestic production and stabilizing prices, given the higher exposure to foreign markets as a result of lower internal cereal yield.

Table 5 outlines the policy responses adopted by the governments of Egypt and Morocco to address the shocks caused by the Covid-19 pandemic and the Russia–Ukraine war.

In the period of the two crises, Egypt maintained import tariff reductions and import simplification, such as fast-tracking customs clearance of cereals to ensure an uninterrupted supply in the face of global disruptions. The governments also implemented short-term controls on staple goods and export monitoring to prevent shortages and stabilize markets during the crisis. Egypt also employed sweeping price controls and subsidies on staple foods, particularly wheat and bread, which protected consumers from rapid inflation hikes. Support programmes, such as cash transfers, were also expanded under Covid-19 to cover vulnerable populations (IMF, 2021). Although Egypt has diversified its sources of cereal imports, it remains highly reliant on wheat imports. Consequently, strategic reserves and stockpiling are a necessary component of its policy in the event of a crisis (World Bank, 2025).

Moroccan and Egypt governments implemented

a range of facilitation measures designed to stabilize

consumer prices. This was particularly important in

preventing hyperinflation, which threatens food

security and exacerbates social unrest

Morocco’s response to the same shocks emphasized strengthening domestic agricultural resilience and diversifying trade partners. During the ongoing aggression of Ukraine, Morocco diversified cereal import origins and emergency wheat import tenders to guarantee availability, even in desperate disruptions elsewhere in the world. Morocco has steered clear of direct export bans but has exercised strict control over exports to stabilize domestic supply and regional trade, unlike Egypt. Domestic policy has been focused on strategic stockpiling, particularly of wheat and fertilizers, to mitigate the combined impact of drought and war-caused supply chain disruptions (OCP Group, 2023). Price subsidies and agricultural incentives were increased during the Covid-19 pandemic to protect the agricultural industry and low-income consumers. Morocco’s government-owned fertilizer producer increased output to compensate for international shortages exacerbated by the war, in line with the country’s policy of leveraging domestic agricultural investments under its food security programme.

Additionally, both governments implemented a range of facilitation measures designed to stabilize consumer prices. This was particularly important in preventing hyperinflation, which threatens food security and exacerbates social unrest. On the domestic side, they introduced price controls and subsidies to shield vulnerable populations from sudden price surges. Moreover, the formation of strategic reserves became a central policy measure to ensure adequate supply during times of crisis. This not only provided a buffer against market fluctuations but also reassured consumers that essential goods would remain available.

Lastly, proactive stockpiling played an important role in both nations’ responses. This comprehensive approach reflects a concerted effort to sustain food security and stabilize the economy amid challenging circumstances.

TABLE 5 The Egyptian and Moroccan Governments’ Policy Responses to the Shocks Regarding Cereal Trade and Domestic Cereal Production

Conclusion

Heavy reliance on a few foreign suppliers to meet high cereal demand, as in Egypt’s case, creates significant vulnerability to external shocks and price volatility. Rising global food prices and supply shortages drive up domestic inflation, undermining the purchasing power of low-income households and deepening food insecurity.

To reduce this dependency, governments must promote sustainable food production. This involves increasing domestic output through smart water management, green energy and climate-smart agriculture — including precision techniques and the sustainable intensification of strategic crops to build resilience against climate change.

Sustainable wheat production

is essential to reduce imports,

save foreign exchange and

enhance food security

In this sense, recent predictions by IFAD, adopting the Climate Adaptation in Rural Development – Assessment Tool (CARD) platform, show a reduction of more than 6% in hectare yields for maize, 5.5% for wheat, and 2.63% for rice for Egypt, under full irrigation, by 2041. For Morocco these reductions are even higher, with 6.33% for wheat and 5.88% for maize, while a lower decline of 1.79% is predicted for rice.

Sustainable wheat production is therefore essential to reduce imports, save foreign exchange and enhance food security. However, this shift also poses long-term risks to soil quality and sustainability. Qualitatively, the reduction in forest areas can exacerbate climate change effects, leading to higher temperatures and reduced rainfall, which in turn affects agricultural yields and water resources. These land use changes can also lead to increased soil erosion and loss of biodiversity, further impacting the agricultural productivity and ecological balance of the region. Therefore, sustainable land management practices are crucial to mitigate these adverse effects and ensure long-term economic and environmental stability.

Moreover, crop diversification is key — particularly in Egypt, where wheat dominates production. Diversifying could not only reduce reliance on a single crop but also shift dietary habits and lower cereal import demand.

Finally, policy support such as subsidies and support for modern, water-efficient farming techniques and less water-intensive crops is critical. Addressing these challenges is essential not just for national food security, but also for broader economic stability in the MENA region in the face of global supply chain disruptions and climate change.

References

Borin, Alessandro & Mancini, Michele. “Measuring what matters in value-added trade.” in Economic System Research, n. 35(4): 586-613, 2023.

International Monetary Fund (IMF). “Arab Republic of Egypt: 2021 Article IV Consultation; Second Review Under the Stand-By Arrangement and Request for a Waiver of Nonobservance of a Performance Criterion and Modification of a Performance Criterion—Press Release; Staff Report; and Statement by the Executive Director for the Arab Republic of Egypt.” IMF Country Report No. 21/165. Washington, D.C.: International Monetary Fund, 2021. www.imf.org/en/Publications/CR/Issues/2021/07/22/Arab-Republic-of-Egypt-2021-Article-IV-Consultation-Second-Review-Under-the-Stand-By-462545. Accessed 20 May 2025.

OCP Group. “Sustainability Integrated Report 2023.” OCP Group, 2023. https://ocpsiteprodsa.blob.core.windows.net/media/2024-07/OCP_Sustainbility_Report_2023_1.pdf. Accessed 20 May 2025.

Staples. “Global agri-food value chains for cereals in the MENA region: Players, Flows, and Stressors.” STAPLES Project developed by PRIMA, Politecnico di Milano. (Available on request).

World Bank. “Understanding Poverty and Inequality in Egypt.” Washington, D.C.: World Bank, 2019.

World Bank. “Strengthening Strategic Grain Reserves to Enhance Food Security.” Washington, D.C.: World Bank, 2025. https://documents1.worldbank.org/curated/en/099042625211562573/pdf/P504545-488431b2-0565-40f9-852c-e8db32d22559.pdf.

Header photo: CAIRO, EGYPT – MAY 2: A man buys Egyptian traditional ‘Baladi’ bread from a bread stand in Al Fustat neighborhood on May 2, 2022 in Cairo, Egypt. Last month, Egypt introduced price controls on commercially sold bread in response to the rising price of wheat. Egypt imports 80% of its wheat supply from Russia and Ukraine, whose production and export have been disrupted by the invasion. (Photo by Roger Anis/Getty Images)