As the first decade of the 21st century comes to a close, the Mediterranean Region is more than ever the focal point of great attention. Two factors account for this situation. First of all, the region constitutes the precipitate of major world tensions and divisions. To look at the Mediterranean is to observe the world and its frailties. Secondly, the region reveals the rise of a strategic multipolarity where power plays are expressed. To analyse the Mediterranean is to acknowledge that the entire world crosses it and to perceive that the waves of globalisation lap at its shores. The Arab uprisings of 2011 certainly confirm these observations.

A New World

The Mediterranean Region is not on the margins of changes at work on the international stage. On the contrary, such changes are making the regional geopolitical order more complex. For Southern and Eastern Mediterranean Countries (SEMCs), this is a time for development of multidirectional relations insofar as both trade and foreign policy. In this regard, it is particularly illuminating to study the growing influence of Brazil, Russia, India and China. These powers have been grouped under the term “BRIC” since 2003, when it was coined by the Goldman Sachs Bank. The emergence of these new actors has undeniably redefined the world order. They represent approximately 3 billion individuals (i.e. 40% of the world’s population) and their combined GDP amounts to 80% of the United State’s GDP. Sometimes we forget, but in 2001, one of the crucial dates was when China entered the World Trade Organization (WTO) on the 11th December.

The increasingly lively market of globalisation results in stepped up interconnections between regional areas. These interdependences are redesigning the cartography of a planet discovering new polarities in the early 21st century. The recession has been accelerating the erosion of power of the US and European countries since 2008. We are witnessing a global geo-economic rebalancing whose boundaries contrast with the political atlas of the second half of the 20th century. Powers whose influence is declining coexist with emerging countries whose ambition is becoming apparent. Yet these geo-economic mutations are currently accompanied by heightened patriotic reactions where each actor stakes its partition without seeking to compose a new collective architecture. Unprecedented power relations are deployed and astonishing alliances formed. Countries can be adversaries one day and partners the next according to the issues on the global agenda. It would certainly be illusory to believe that multipolarity contributes to strengthening world stability. In the absence of sufficient reforms, multilateralism is losing ground, for its rules now prove inadequate for such polycentrism. The creation of the G20 constitutes an attempted response, but the results for the time being are quite meagre.

Dynamics in the Mediterranean

The presence of the Big Four in the Mediterranean Region is growing and diversifying. First of all we must emphasize to what point the intervention of the BRIC countries in the region affects the Northern Mediterranean. Indeed, in 2010, investments by BRIC actors in European Union (EU) countries increased and China contributed economic aid to certain countries suffering from the recession by purchasing public debt (Greece, Spain). Apart from this massive entry of capital, it must be noted that in 2009, a third of EU imports were from the BRICs (of which 19% were from China) and that this group was the destination for 20% of European exports (of which 8% went to China).

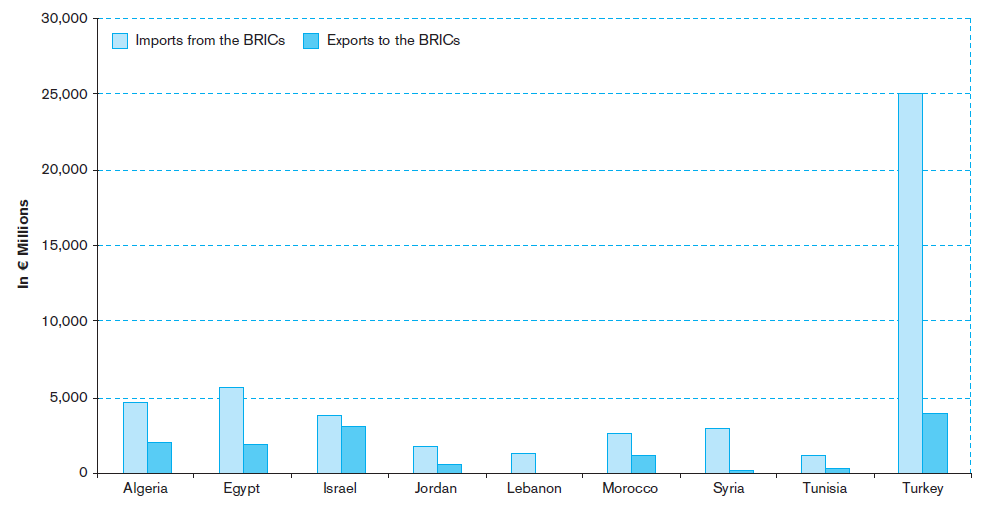

With regard to the SEMCs, it is likewise through the lens of trade and the taking up of economic positions that moves are being made. The BRIC countries have undeniably gained the upper hand over the SEMCs, since they exported some 49 billion euros’ worth of products there in 2009 (China alone accounting for 50% of this trade and Turkey polarising half of it). In contrast, in the same year, the SEMCs made a total of 13 billion euros’ worth of exports to the BRICs (with an equal weight of 25% for each power in the BRIC group). Moreover, it must be taken into account that a fourth of Turkish imports were from the BRIC countries and that this rate rose to 17-18% for Algeria, Egypt, Jordan and Syria. At the same time, the BRICs represent a significant destination for exports from certain SEMCs: 15% of Jordan’s exports go there, 12% of Morocco’s and 11% of Egypt’s. Tunisia, on the other hand, more oriented towards the European market, displays the least BRIC-oriented geo-economic profile. With regard to foreign direct investment (FDI), approximately 10% of the amounts registered in the SEMCs in 2010 were from public or private BRICs.

China Triumphant

The second largest economy in the world has multiplied its alliances in the Mediterranean area. First through investment, being active in a number of sectors such as public infrastructure works (through the public company, China State Construction and Engineering Corporation), the automotive industry, fisheries, textile and electronics, not to mention oil (in Algeria and Libya) or phosphates (in Morocco), resources sought after by Beijing for its domestic supply strategy. In 2010, China was the 4th most important investor in the SEMCs. Hence, in Ain Sokhna, on the western shore of the Red Sea in Egypt, a special economic area was established for Chinese companies. Wishing to capture European and African markets, China seems to be casting its sights on certain Mediterranean ports with the aim of using them as distribution platforms for its merchandise. These relations between the Asian giant and Arab countries are evident in certain widely commented symbols, such as the Chinese workers employed in Algeria or the famous Palestinian keffiyeh, which are primarily manufactured in China. Another strategic sector is nuclear power: Algeria has an experimental reactor in Aïn Oussara supplied by Beijing, which aims to compete in the field with the technology of France.

With regard to trade, in 2009 China ranks 2nd in volume of imports for Algeria, Morocco and Syria, and 3rd for Egypt, Israel, Jordan, Tunisia and Turkey. Hence, China has become a major trade partner of all the SEMCs. The trade balance is steeply tilted in Beijing’s favour, the latter exporting some 23.7 billion euros to the SEMCs, whereas it imports only 3.5 billion euros’ worth of merchandise from this group of countries. In any case, it is interesting to note that China ranks 4th as a destination for Moroccan exports and 6th for Egyptian exports.

On the political level, a number of SEMCs participate in Chinese-African summits, the latest of which was held in Egypt in November of 2009. On the sensitive topic of Western Sahara, China regularly indicates its support for Algeria’s positions at the United Nations negotiating table. Beijing likewise charms its partners by using chequebook diplomacy. During the 2008-2010 period, the amount of loans that China granted to developing countries was greater than the World Bank’s commitments. The mobilisation of its considerable exchange reserves (2,800 billion dollars in January 2011) contributes to boosting Beijing’s international influence, for this aid does not go without diplomatic compensations. In the SEMCs, the Chinese presence is also evident in a diaspora that is becoming progressively more organised and whose numbers are difficult to quantify. The creation of numerous Confucius Institutes where Mandarin Chinese courses are offered indicates moreover a distinct will to step up cultural action and thereby improve knowledge on China, whose culture is little known in Arab societies. The rapid growth of Chinese tourist flows in the world could become an interesting market for the SEMCs in the medium term, in particular Turkey, on the economic level but also (and why not?) insofar as cultural exchanges.

TABLE 1 Chinese Trade with the SEMCs in 2009

| Imports from China | Imports from China | Exports to China | Exports to China | |

| Rank | Volume (in € millions) | Rank | Volume (in € millions) | |

| Algeria | 2 | 3,423 | 7 | 608 |

| Egypt | 3 | 2,804 | 6 | 688 |

| Israel | 3 | 2,523 | 6 | 741 |

| Jordan | 3 | 1,122 | 18 | 29 |

| Lebanon | 4 | 835 | 32 | 6 |

| Morocco | 2 | 1,677 | 4 | 242 |

| Syria | 2 | 1,740 | 27 | 6 |

| Tunisia | 3 | 559 | 9 | 71 |

| Turkey | 3 | 9,054 | 12 | 1,131 |

Source: DG Trade (March 2011)

CHART 1 Chinese Trade with the SEMCs in 2009

India Advances its Pawns

The “largest democracy” in the world is also beginning to enter the Arab world, with a greater orientation towards the Middle East than Northern Africa at this stage. Expanding major Indian multinationals, also present in Southern Europe (Italy, Cyprus, Greece), should be able to capture the Southern Mediterranean markets over the forthcoming years as well. The 4th largest world economy seems to be entering the area gradually. The chemical, plastics, information technology and textile industries are the targets. Yet India, like China, is experiencing a rise in its internal energy needs and it does not view the oil and gas resources in certain SEMCs with indifference. The same is true of Morocco’s phosphates, half of the sales of which go to the Indian market, where agriculture remains linked with the model of the Green Revolution. Indeed, the phosphates of the Sharifian Kingdom constitute one of the priority targets of Indian investment in the region.

Insofar as trade, India is far behind the Chinese power in terms of geo-economic position vis-à-vis the SEMCs. In fact, trade was nearly balanced, with New Delhi exporting some 4.6 billion euros’ worth of products in 2009, whereas it imported nearly 4.2 billion euros’ worth from the SEMCs. India primarily trades with Egypt and Israel, though it also has another essential client, namely, Turkey, whose Indian imports are significant in comparison to its exports to New Delhi. Another interesting point is that India ranks 2nd as a destination for Moroccan exports and 3rd for Egyptian and Jordanian exports. In sum, though the SEMCs are not a major destination for overall Indian exports, India does constitute a strategic export market for certain SEMCs.

TABLE 2 Indian Trade with the SEMCs in 2009

| Imports from India | Imports from India | Exports to India | Exports to India | |

| Rank | Volume (in € millions) | Rank | Volume (in € millions) | |

| Algeria | 9 | 585 | 8 | 346 |

| Egypt | 9 | 898 | 3 | 1,033 |

| Israel | 7 | 825 | 4 | 1,299 |

| Jordan | 13 | 217 | 3 | 489 |

| Lebanon | 18 | 108 | 38 | 4 |

| Morocco | 15 | 180 | 2 | 469 |

| Syria | 14 | 267 | 12 | 106 |

| Tunisia | 9 | 165 | 5 | 154 |

| Turkey | 11 | 1,356 | 25 | 294 |

Source: DG Trade (March 2011)

CHART 2 Indian Trade with the SEMCs in 2009

Brazil Is Asserting Itself

Desirous of promoting South-South relations, Brazil implemented a proactive, assertive foreign policy under the Lula Administration (2002-2010). With a significant Arab socio-historical heritage (12 million Brazilians are of Arab origin, with a strong Lebanese community that organised a large Arab culture festival in Sao Paulo in March of 2010), the 8th largest world economy has applied itself to intensifying relations with the Arab world. Two Summits of Heads of State and Governments from South American and Arab countries, held respectively in Brasilia in 2005 and in Doha in 2009, have allowed the development of economic cooperation in mutually profitable sectors and the effecting of diplomatic moves in a context at times requiring true acrobatics. This is the case of Brazil’s cooperation, together with Turkey, on the Iranian nuclear power issue in May 2010 or the recognition of the Palestinian State in December 2010. These commitments, accompanied by reiterated criticism of Israeli settlements, have consolidated the sympathy that Brasilia enjoys among numerous Arab countries. Moreover, certain leaders have expressed the wish to have Brazil play the role of mediator in Israeli-Palestinian negotiations. Aspiring to a permanent seat on the UN Security Council, Brazil knows that its audacious, pro-Arab diplomacy can serve its interests.

But this policy has first resulted in shared growth. Since 2002, trade between Brazil and Arab countries has quadrupled. Brazilian companies such as Petrobras (energy), Randon (industrial vehicles) or Norberto Odebrecht (infrastructures) are increasingly active. Within the framework of Mercosur, trade liberation is being established with Morocco, Jordan, Egypt and Syria. All trade figures between Brazil and Arab countries have been on an upward trend over the past few years and the interregional potential seems as yet underexploited. Indeed, volumes remain lower than those prevailing with India or China. The most dynamic SEMCs insofar as exports to Brazil are Algeria, Israel, Turkey and Morocco. Brazil, on the other hand, exports primarily to Egypt. Note that Brazil ranks 7th for Moroccan imports and 8th for Algerian imports.

Apart from this geographic polarisation on a few SEMCs, another aspect of Brazil’s trade with Mediterranean countries is that it focuses on agricultural products (sugar, meats and maize) and raw materials (oil, phosphate and fertilisers). There is a very high potential for synergies between Brazil and the SEMCs. For instance, the modern, exportable Brazilian agriculture perfectly fits with the structural dependence of Arab Mediterranean countries on the international market to feed their populations. Brazil’s agricultural sales have thus gone from 1.5 to 7 billion dollars between 2000 and 2009, comprising more than half of total Brazilian exports to Arab countries.

TABLE 3 Brazilian Trade with the SEMCs in 2009

| Imports from Brazil | Imports from Brazil | Exports to Brazil | Exports to Brazil | |

| Rank | Volume (in € millions) | Rank | Volume (in € millions) | |

| Algeria | 8 | 632 | 6 | 1,034 |

| Egypt | 11 | 886 | 39 | 32 |

| Israel | 15 | 149 | 9 | 494 |

| Jordan | 14 | 133 | 36 | 4 |

| Lebanon | 10 | 255 | 82 | 1 |

| Morocco | 7 | 411 | 6 | 220 |

| Syria | 16 | 237 | 33 | 3 |

| Tunisia | 12 | 107 | 10 | 62 |

| Turkey | 14 | 792 | 27 | 275 |

Source: DG Trade (March 2011)

CHART 3 Brazilian Trade with the SEMCs in 2009

Russia, Near and Yet Distant

Russia is a specific case. It is the re-emergence of a power that slumbered for the duration of a complete transition after the Fall of the Berlin Wall in 1989. Two decades later, Russia is making a comeback in international affairs, though without giving sure signs of a definite takeoff. The sixth largest world economy, it is not shying away from a Mediterranean stage historically perceived as strategic by Moscow. The Russian fleet remains stationed in Sebastopol, arms contracts are concluded regularly with certain SEMCs and numerous tourists seeking the sun spend holidays every year on Turkey’s southern coast. Russia, a member of the Quartet on the Middle East, maintains very close relations with Syria and Iran, which lends it a significant diplomatic advantage in the region. At the same time, convergences are emerging with Israel, where the Jewish community of Russian origin greatly increased in the early 1990s.

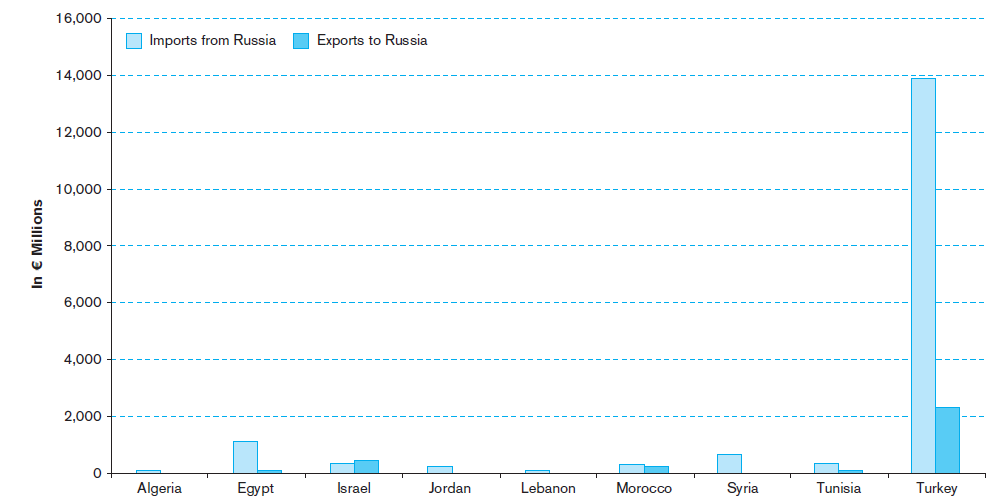

Concerning trade, Moscow primarily does business with Turkey. Russia holds the 2nd position in imports effected by Ankara, and is the 5th most important destination for Turkish exports. Moreover, strategic relations are being established in the nuclear power domain. In 2010, a bilateral agreement for the installation of a power plant in Akkuyu, southern Turkey, just across from the Greek island of Rhodes, was signed by these two countries that border on the Black Sea. Like China, India and Brazil, however, Moscow also aims to establish ties with the African continent and its natural resources. Looking beyond the Anatolian plateau, it is entering the area full force, multiplying its partnership agreements in the energy sector (Algeria, Libya) through the active entrepreneurship of its Gazprom company. In Northern Africa, Russia’s most important clients are in the cereal sector and it is increasingly exporting its wheat there, in particular to the Egyptian and Syrian markets, accounting for Moscow’s 6th and 7th position, respectively, in cereal imports effected by these countries.

TABLE 4 Russian Trade with the SEMCs in 2009

| Imports from Russia | Imports from Russia | Exports to Russia | Exports to Russia | |

| Rank | Volume (in € millions) | Rank | Volume (in € millions) | |

| Algeria | 26 | 85 | ||

| Egypt | 6 | 1,112 | 21 | 118 |

| Israel | 11 | 345 | 10 | 469 |

| Jordan | 10 | 248 | 28 | 11 |

| Lebanon | 19 | 106 | 27 | 9 |

| Morocco | 9 | 304 | 5 | 234 |

| Syria | 7 | 672 | 15 | 25 |

| Tunisia | 7 | 335 | 13 | 38 |

| Turkey | 2 | 13,913 | 5 | 2,293 |

Source: DG Trade (March 2011)

CHART 4 Russian Trade with the SEMCs in 2009

2011: Towards a New Mediterranean?

Though economic aspects predominate in relations between the SEMCs and the BRIC countries, the political facet should not be ignored. The global recession has served as a catalyst for geo-economic rapprochement between the BRICs and the SEMCs since 2008. But the exacerbation of tensions in the Arab world since the beginning of 2011 could slow down the convergences against a backdrop of geopolitical malaise.

For some years now, in recurrent debates on multipolarity, two ideological models have often been contrasted, though they are sometimes complimentary – due to globalisation – but inevitably antithetical – the universalism of certain values. On the one hand is the famous Washington Consensus, dear to Americans and Europeans, consisting in liberalising the economy and proposing the most democratic governance possible. On the other hand lies what is termed the Beijing Consensus, as it is based on China’s course of actions, namely the combination of a broad opening up to capitalism and the rigidity of a system under the aegis of a single party. Though China has refrained from touting its model, the latter has nonetheless spread progressively throughout the world. This infusion has also affected the SEMCs. The governing elite have been lured by the model of such an economic takeoff without political criteria. Frankly, the Chinese model could better correspond to the aspirations and dynamics of the Arab world, winning out over Western discourse on the need to democratize the region. Certainly, the revolts that have been shaking the majority of the SEMCs since the beginning of 2011 have astonished public opinion and governments the world over. These are truly popular uprisings originating in the streets, uniting people of different generations and amalgamating all the discontent, from the absence of rights to the precariousness caused by the elevated cost of living, not to mention the central issue of employment. At Cairo’s Tahrir Square in February 2011, thirst for freedoms and the desire for social equality were expressed in a generalised movement. A regime fell because it erroneously believed that the population would indefinitely support authoritarianism in a process of economic progress. This belief, however, reflects a lack of awareness of the hidden face of bad development, when the benefits of growth are not shared and social misery grows under the effect of uneven globalisation.

Although the Washington Consensus entails numerous limitations, the Beijing Consensus likewise displayed its own in early 2011. It is indeed not trivial to note how closely the Chinese authorities, as well as the Russian ones, have followed the uprisings shaking the Arab countries and the revolutions in Tunisia and Egypt. This observation is not made simply because jasmine originally comes from Asian lands, but naturally because the ailments of the Arab world show certain similarities with those encountered in China and Russia (social inequality, lack of individual liberties, exclusion and pauperisation of outlying areas, oppressed minorities). Clearly, the cultural and political contexts are not identical, yet several factors can legitimately make Beijing fear experiencing a similar scenario of mixed social protest and political demands on the medium term. Beyond the control effected on internet and the surveillance of certain sectors of educated youth, China specifically organized in the face of the events occurring in Northern Africa by dispatching its naval forces to assist the tens of millions of Chinese fleeing the fighting in Libya. On the other hand, from the perspective of stalling the revolutions and recurrent troubles in the SEMCs, a scenario they cannot rule out, the Chinese authorities have a tendency to tout the “society of wellbeing”, a formula adopted in the spring of 2011 to raise the population’s awareness of the virtues of stability and control.

Brazil likewise views what is happening in the Mediterranean/Middle East region with great prudence. After having boosted its allegiances in the area under both Lula terms, Brasilia now seems more concerned with conducting a foreign policy having greater respect for human rights since the beginning of January 2011, under the presidency of Dilma Roussef. The country seems to carry a lot of sway to have managed to postpone the 3rd Summit of South American and Arab Countries, which was originally to be held in Peru on 16 February 2011. Like the other BRICs, on 17 March 2011, Brazil did not oppose the United Nations resolution authorising foreign intervention in the Libyan conflict, allegedly to afford protection to the local population. Yet as soon as said intervention was placed under the aegis of NATO, Brasilia called for a cease-fire and the suspension of military operations. This turnaround can also be ascribed to the strategic stance adopted by a Brazilian power that has been offering an alternative dialogue for several years vis-à-vis Arab countries. Since 2002, Brazil has observer status on the Arab League, just as India since 2007. Lula has often emphasised the specificity of his country. In contrast to the United States and Europe, Brazil arrives on the scene without a historical or political legacy. It appears as an honest, less moralising partner, not masking its economic artillery behind a diplomatic dance, and moreover, it does not declare systematic alignment with either American or European postures. Keeping an incontrovertible international aura, in particular in the Southern countries, Lula, the guest of honour, even allowed himself to pronounce an apology of democracy at the 6th Annual Al Jazeera Forum held in Doha on 13 March 2011, without causing a stir among the participants nor in the region. It is true that Arab countries could take inspiration from certain Latin American transitions, where the change from dictatorship to democracy was effected with errors that should not be repeated. Rather than an exportable model of transition, it would be more appropriate to speak of a learning process, as suggested by Lula.

TABLE 5 Trade of BRIC Countries with SEMCs in 2009

| Imports from BRIC Countries | Imports from BRIC Countries | Exports to BRIC Countries | Exports to BRIC Countries | |

| € Millions | % of Total Trade | € Millions | % of Total Trade | |

| Algeria | 4,725 | 16 | 1,988 | 6 |

| Egypt | 5,699 | 18 | 1,870 | 11 |

| Israel | 3,842 | 12 | 3,002 | 9 |

| Jordan | 1,720 | 17 | 534 | 15 |

| Lebanon | 1,303 | 11 | 19 | 1 |

| Morocco | 2,572 | 12 | 1,166 | 12 |

| Syria | 2,916 | 18 | 140 | 2 |

| Tunisia | 1,165 | 8 | 325 | 3 |

| Turkey | 25,116 | 25 | 3,993 | 6 |

Source: DG Trade (March 2011)

CHART 4 Trade of BRIC Countries with SEMCs in 2009

CHART 5 Total Trade of BRIC Countries with SEMCs in 2009

Prospective Reflections

It goes without saying that the year 2011 opens a new geopolitical period for the Mediterranean Region. All major powers will have to readjust their strategies in a context that is at once turbulent, fragile and transformed. The United States, just as Europe, will most certainly seek to support the changes and foster democratisation. For Washington, as is often the case, it is the safeguarding of American interests that will prevail, although the Obama Administration has admittedly effected a relatively controlled management of the Arab crises. This said, the United States is not quite convincing because it is no longer credible in its regional discourse. Washington promises progress in the Middle East, but nothing is changing in favour of the Palestinians. Legacies are weighty and it is evident that the US, which used to shape History, simply follows it now. This is particularly true in the Arab world, where its defeats have been stinging whenever it has attempted to remodel the region according to its own strategic agenda.

For Brussels, the issue is major and complex, since geographic proximity elicits various concerns. The temptation of isolationism emerges. The SEMCs themselves, whose dissimilarities are growing more accentuated, may also behave with less enthusiasm towards European countries. Distrust and disappointments may win out over tropisms towards the other shores of the Mediterranean. Divided insofar as it external action and economically weakened, Europe does not have the means to match its ambitions. The skies over Euro-Mediterranean cooperation are currently cloudy, if not outright stormy, whereas the challenges are such that they require multilateral approaches. With the audacious idea of the Euro-Mediterranean Partnership, launched in the late 20th century, the aim was to strategically strengthen the geographic neighbourhood, to the point of speaking of a regionalisation of globalisation and progressive integration between two unequally developed areas. More than fifteen years after Barcelona, this scenario has not materialised. Europe will most likely be tempted to use the instruments of the European Neighbourhood Policy (ENP), which endorse differentiation and the conditionality of relations with the SEMCs. The bilateralisation of relations could thus grow, and the failure of the Union of the Mediterranean will but stimulate this. The absence of political determination and intra-EU divisions have won out over the Euro-Mediterranean ambition, although in 2009, the EU was still the leading source of imports for all the SEMCs (and likewise with regard to export destination for Turkey and the Northern African countries). The density of human and economic relations between Europe and the SEMCs is not materialised on the diplomatic and geostrategic levels. Although still incontrovertible, Europe could see its influence diminish even further for lack of leadership.

Concerning the BRICs, certain dampers on their influence are likely. Although the term “BRIC” rapidly gained popularity on geo-economic foundations, the concept remains controversial, for these countries do not form a homogenous geopolitical bloc, despite annual summits beginning in 2009 aiming to create political and trade convergences between the four powers (in 2011, South Africa officially joined the group, a fifth letter being added to the acronym to become “BRICS”). Two of these countries are democracies (India and Brazil), two are demographic giants (India and China), three are nuclear powers (India, China and Russia) and two are home to a UN Security Council office (China, Russia). Moreover, these powers show signs of endogenous weaknesses that could alter their economic performance. Nonetheless, forecasts made in 2010 are striking insofar as speed of geo-economic shifts: in 2011, Brazil’s GDP is supposed to surpass that of France and that of India surpass Japan’s, while by 2014, Russia’s GDP should outstrip Germany’s, and by 2019, China’s GDP could surpass that of the United States (the forecast made by Goldman Sachs in 2003 pointed to the year 2041…). Over the coming decade, the BRICS countries will represent 50 to 70% of the world’s GDP growth in real terms. These projections are, however, relative, for the global recession could also contribute to slowing their economic growth.

As a trend, the atomisation of the Mediterranean could be confirmed over the coming decade. The SEMCs, increasingly heterogeneous, will pursue multidirectional strategies for their trade and political affairs. Europe, weakened and discredited, will lose more influence. Its priorities will distance it from South Mediterranean shores. It will have to save itself, consolidate its enlargement in Eastern Europe, stabilise the Balkans and decide on Turkey’s accession. At the same time, the BRICS will accentuate and diversify their presence, with inevitable competition among themselves for the area. Exacerbated avidity for rare resources and competition between the powers will contribute to fragmenting the Mediterranean area. The Arab countries, using these rivalries, could possibly develop unprecedented political models corresponding neither to Western models nor to the Beijing Consensus. Via revolution or reform, the political landscape of these countries could evolve over the coming years, whether for better or worse.

This scenario is not cause for celebration. However, there is no need for concern regarding the involvement of the BRICs in Mediterranean affairs. On the contrary, this dynamic demonstrates that the SEMCs are participating in globalisation and that the entire world is involved in the Mediterranean bazaar. Above all, far from threatening the imagined integrity of a jigsaw-puzzle region, all of these changes actually question the current relevance of the Euro-Mediterranean idea. Although it remains desirable according to many opinions, can we believe that it remains conceivable and feasible under its current approach? The world has changed, and the Mediterranean with it. This should not lead us to fear these developments, but rather to support the transformations and adapt to them.

References

Abis S. (editor), “La Méditerranée sans l’Europe”, Confluences Méditerranée, No. 74, Paris, L’Harmattan, September 2010.

European Commission, DG Trade, Statistics on Trade, Bilateral Relations, updated on 17 March 2011.

Halper S., The Beijing Consensus. How China’s Authoritarian Model Will dominate the 21st Century, Basic Books, 2010.

Hawksworth J., Tiwari A., The World in 2050. The accelerating shift of global economic power: challenges and opportunities, PriceWaterHouseCoopers, London, January 2011.

Menon R., Enders Wimbush S., “New Players in the Mediterranean”, The German Marshall Fund of the United States, Mediterranean Paper Series, May 2010.

Simpfendorfer B., The New Silk Road. How a Rising Arab World Is Turning Away from the West and Rediscovering China, Palgrave Macmillan, April 2009.