Energy subsidies have traditionally played an important role in Middle Eastern and North African economies. Subsidies still represent a major component of social protection in the majority of Southern Mediterranean countries where low prices for energy and food play a significant role in reducing poverty and protecting vulnerable households. However, subsidies present a number of important shortcomings, both in terms of efficiency and equity. The need for a drastic reduction in subsidies became clear during the first years of the century, when oil prices rapidly increased triggering debt accumulation and pressure on public budgets, especially on energy-importing countries. In the last decade a number of countries have been able to start a gradual phasing out of subsidies, in some cases replaced by more efficient forms of social protection. However, subsidy removal and the introduction of more sophisticated social protection measures represent a complex process, which in many cases is implemented in a highly unstable political context, and it is still far from been concluded.

Subsidies Have a Role in Fighting Poverty and Mitigating the Adverse Effects of Price Fluctuation

Although a system of subsidies is common to the large majority of Southern Mediterranean countries, the mechanisms, entities, and products involved differ across countries.[1] In Algeria for example the energy products subsidy is large, but implicit in the government energy pricing, while in Tunisia, the food subsidy system absorbs a larger share of the government budget than energy subsidies. In Egypt, in contrast, around 70% of subsidy spending is used to lower oil and gas prices.

Energy subsidies have been introduced to meet a number of objectives. The first is to protect vulnerable households from rising prices. To achieve this, subsidises are often concentrated on types of good typically consumed by the poor such as food, kerosene, or diesel. However, in many cases subsidies have involved a vast range of energy goods including electricity, fuel, and gas. The rationale for universal subsidies is to offset temporary commodity price fluctuations. Energy is a fundamental input for the vast majority of economic sectors, as higher prices here have repercussions on all markets and trigger inflationary pressures. This issue is particularly relevant for countries that are unable to anchor inflation expectations. Finally, energy subsidies have been defended on the grounds of their ability to facilitate the development of energy-intensive industries such as petrochemicals and cement. Despite all the above-mentioned desirable effects, subsidies have been roundly criticised.

Energy Subsidies Have Wide-Ranging Negative Economic Consequences on Southern Mediterranean Economies

Subsidies have been criticised on equity grounds because of their targeting inefficiencies. Del Granado et al. (2010) show that richer households systematically reap more benefits from subsidies than poorer households in 20 developing economies. In urban Egypt, for example, the top quintile of the income distribution receives eight times as much in energy subsidies as the bottom quintile (Roach, 2013). In Morocco, households in the top quintile of the income distribution are shown to get more than 75% of diesel subsidies (Vaglasindi, 2013).

From an efficiency standpoint, the subsidisation of fuel and gas encourages wasteful consumption of polluting, exhaustible resources. Fattouh and El-Katiri (2012) show how total primary energy consumption per dollar of GDP over the last 30 years has declined in all parts of the world, with the exception of the Arab world. The highest rates of increase in energy intensity are recorded in Gulf countries, but energy intensity is also increasing in some Mediterranean countries, namely Morocco, Algeria, Egypt and Syria. Low energy pricing contributes to distortions of relative prices, which, in turn, lead to underinvestment in non-subsidised energy sectors. Moreover, the low prices of fuel and gas discourage the development of alternative energies and encourage smuggling. Therefore a realistic estimate of subsidy costs is much higher than the sum of financial subsidies explicitly recorded in the public budget, and should also include all economic distortions caused by artificially low energy prices.

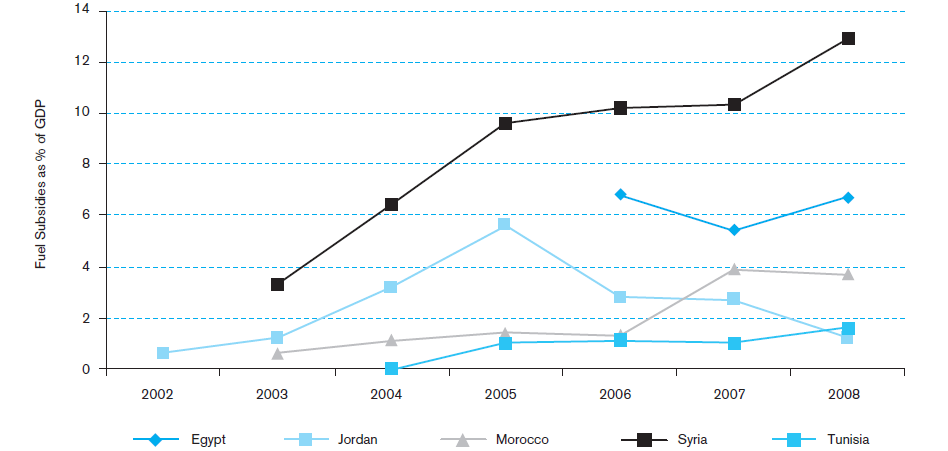

The years before the 2008 financial crisis were characterised by increasingly high food and energy prices. This sharp increase in prices directly affected the population’s well-being, especially in food and oil-importing countries. Moreover, soaring prices worsened the sustainability of public budgets in all countries where food and energy prices were subsidised. Today the need to remove subsidies is one of the big issues on the political agenda in most Middle Eastern and North African countries. Chart 1 shows how the total government expenditure on oil subsidies is shared, as estimated by Elbers and Peeters (2011). Note, however, that this chart does not include implicit subsidies for energy such as the pricing policy in Algeria.

Subsidy removal and the introduction of more sophisticated social protection measures represent a complex process, which in many cases is implemented in a highly unstable political context

CHART 1 Share of Total Government Expenditure in Oil Subsidies (2002-2008)

Other countries have been threatened by similar explosive trends in subsidy expenditure. The IMF (2012) estimated that in Libya, subsidies and transfers have increased from 11.7% of GDP before the revolution, to 15.9% of GDP in 2012, close to a quarter of the government’s total expenditure.

Subsidy Reforms Have Historically Been Very Unpopular: the Area’s Current Political Instability Is Jeopardising Ongoing and Planned Reforms

The budget sustainability of food and energy subsidies led to an initial wave of reforms in the 1980s, which were often included in structural adjustment programmes and linked to credit lines agreed with the IMF and World Bank. Morocco is one of the first countries in the region that attempted to reform its subsidies scheme in the mid-1980s. More recently, Morocco started to phase out all energy subsidies – with the exception of LPG – to reflect international prices. The subsequent price hikes met with strong political opposition, and today the government has only partially indexed energy prices to international market levels. Jordan moved toward an automatic fuel pricing mechanism between 2005 and 2008. However, in January 2011, the country temporarily suspended the mechanism because of popular opposition. In Lebanon fuel price subsidies were eliminated in 2008 with the reintroduction of fuel excise taxes. However, because of increasing international market prices and political pressure, the government reduced excise taxes in 2011. Tunisia is another country struggling to reform its subsidy system. After a number of gradual increases (2005-2009) and the fall of the Zine El-Abidine Ben Ali government, the complete removal of subsidies was programmed. However, the government recently decided to suspend the increase in energy prices planned for the 2014 budget. Reforms have also been suspended or delayed due to conflicts and politically instability in Egypt, Syria and Libya. In Egypt, the government increased petrol prices, cut subsidies on electricity and natural gas between 2004 and 2008 and then, in 2010, introduced a quota system for LPG. Nevertheless, fuel prices in Egypt remain among the cheapest in the world. In recent months, the government has delayed the implementation of an electronic-card-based quota system, initiated by the former President Mohamed Morsi. Libya is expected to remove all kinds of subsidies in the next three years and has started to advertise its intention to compensate citizens with cash handouts. Finally, Syria also planned a broad reform of its subsidy scheme and fuel prices started to increase gradually in 2008. The subsidy cuts were interrupted in 2011 due to the ongoing conflicts in most areas of the country. However, in 2013, after two years of war, Syria has doubled the price of diesel fuel to reduce the cost of maintaining universal subsidies for the population.

To Be Politically Viable, Phasing out Subsidies Should Be Accompanied by the Introduction of a Modern System of Social Protection

The large number of recipients explains why, since the late 1970s, attempts to reform subsidy systems have been challenged by strong popular reactions in Egypt (1977), Morocco (1984), and Tunisia (1984). More recently, in reaction to the protests and riots of the ‘Arab Spring,’ most Arab countries increased their subsidies or suspended planned subsidy cuts. To prevent political opposition, a successful subsidy reform should be accompanied by a series of complementary reforms to neutralise the negative effects of higher energy prices. A safety net is often suggested as the best substitute for subsidies. However, cash transfers are often not feasible because governments lack the capacity to implement complex social protection mechanisms. In such cases, governments can implement packages of short-term measures to mitigate the impact of price increases. Moreover, subsidies can be improved by inducing self-targeting mechanisms.

All the Southern Mediterranean countries, including Gaza and West Bank territories, have some form of cash transfers for low-income households. In many cases these social benefits have been reinforced alongside the phasing out of subsidies. However, social benefits often remain unsystematic in the region and in some cases their scale and coverage are limited.[2]

In Jordan the government introduced a number of programmes to counterbalance the negative effects of subsidy removal, such as tax exemptions on basic food products and an increase in the role of the National Aid Fund, a well developed social safety net scheme which is estimated to reach between 8% and 9% of the population. In Jordan, total spending on the safety net is estimated to be above 1% of GDP (Vagliasindi, 2013).

Conditional cash transfers represent an alternative to subsidies and have been adopted to achieve social protection together with other objectives such as improvements in school attendance. The Tayssir programme in Morocco made cash payments to parents with children in primary school resulting in substantial improvements in education attendance in more than 300 rural school districts between 2008 and 2010. Similarly, in Algeria the school meal programme has a twofold objective: to promote primary education and to target malnutrition and extreme poverty. The programme covers more than three million children attending primary school and is planned to achieve universal coverage by the end of 2014. In this case, school meals are complementary to a system of allowances that target particular groups (e.g. people with disabilities, widows, orphans, low-income households), which covers over 670,000 households (Marcus et al, 2011).

In areas of conflict, especially Syria and Libya, the growing number of refugees has put pressure on national social protection systems. The Syrian conflict is considered the world’s largest refugee crisis in recent decades, with more than seven million refugees, two and half of them displaced in neighbouring countries. Syrian refugees are targeted by a number of emergency actions to guarantee basic necessities. However, more comprehensive policies are needed, especially in Jordan and Lebanon.

The Way Forward

In the last decade, Southern Mediterranean countries have embarked on comprehensive reforms of their subsidies. Despite a long list of adverse effects, energy subsidies represent an important social safety net for poor and vulnerable households. Any attempt to eliminate or cut subsidies in absence of some form of compensatory programmes would lead to a decline in households’ welfare. Del Granado et al. (2010), for example, show that a $0.25 per litre increase in fuel prices in Jordan could reduce real consumption of the poorest 20% of households by more than 5%. There are some key ingredients that are likely to ease the process of reform, among others: public awareness, gradual phase out, and targeted social benefits to compensate ‘losers.’ However, there is not a single formula. Each country has to find the most suitable tools taking into account its socioeconomic and political context and traditional mechanisms of social protection. Efficiency gains from subsidy removals are very high, and reforms have the potential to be a source of political support rather than a source of political opposition and instability.

Notes

[1] In what follows, a subsidy is defined as any measure that keeps prices for consumers below the market level.

[2] Marcus et al. (2011) present a review of policies implemented in the area with a focus on child-sensitive social protection.

References

Del Granado, Arze, Coady, Javier David, and Gillingham, Robert. “The Unequal Benefits of Fuel Subsidies: A Review of Evidence for Developing Countries,” World Development, 40: 2234–2248, 2012

Albers, Ronald and Peeters, Marga. “Food and Energy Prices, Government Subsidies and Fiscal Balances in South Mediterranean Countries,” Economic Papers 437, Directorate General for Economic and Financial Affair, European Commission,2011

Fattouh, Bassam and El-Katiri. “Energy Subsidies in the Arab World.” Arab Human Development Report Research Paper Series, United Nations Development Programme, 2012.

International Monetary Fund (IMF). Libya beyond the Revolution: Challenges and Opportunities, Washington, DC, 2012

Roach, Dalibro. “Solving Egypt’s Subsidy Problem,” Cato Institute’s Centre for Global Liberty and Prosperity Policy Analysis 741, November 6, 2013

Marcus, Rachel, Pareznieto, Paola, Cullen, Erin, Jones, Nicola. “Children and social protection in the Middle East and North Africa. A mapping exercise.” Working Paper 335, Results of ODI research presented in preliminary form for discussion and critical comment, 2011

Vagliasindi, Maria. “Implementing Energy Subsidy Reforms. Evidence from Developing Countries,” The World Bank, Washington DC,2013